The global semiconductor industry has experienced many challenges over the past several years amidst a growth in demand for semiconductors in products from earbuds to automobiles. Analysts are now optimistic the industry has begun recovery that will continue into 2024. World Semiconductor Trade Statistics (WSTS) predicts growth of 11.8% in 2024. In the area of AI semiconductor revenue, Gartner anticipates double-digit growth of more than 25%, to $67.1 billion.

Among the many factors that will contribute to the growth will be the ability of semiconductor manufacturers to make the most of several key innovations:- Artificial Intelligence: as much as AI is placing demands on chip manufacturers for AI-ready hardware, the semiconductor companies themselves have embraced the potential of AI to improve process quality, optimize production, and increase efficiency in their fabs.

- Internet of Things: has spurred demand for semiconductors while also being employed by the industry to help keep up with that demand. IoT devices have found their way into the production environment for real-time data capture and monitoring of tools, equipment, and processes. Armed with the right automation solution, these devices facilitate continuous process improvement.

- Simulated Fabrication: developing new recipes and processes is costly and time consuming. Simulation, or virtual modeling, with AI and ML models enables manufacturers to simulate the process flow. They can generate a high volume of data in days instead of in the weeks or months it would take to produce enough wafers to gather this data. The models can quickly provide insights into bottlenecks, cycle time and output, as well as predict problems that may impact products—all without having to interrupt current production.

- Innovative Technologies: increasingly smaller chips necessitate greater accuracy in placement of both patterns and wiring. Manufacturers have turned to advances in fabrication technology such as robotic wafer handling and unique fabrication techniques such as additive manufacturing.

- Innovative Materials: semiconductor companies have looked to materials such as gallium nitride (GaN) and silicon carbide (SiC), to achieve higher operating temperatures, high voltage resistance, a smaller form factor, and faster switching. Manufacturers’ continued ingenuity in working with innovative materials will help them overcome chip size limitations.

The global semiconductor industry has experienced many challenges over the past several years amidst a growth in demand for semiconductors in products from earbuds to automobiles. Analysts are now optimistic that the industry has begun recovery that will continue into 2024. World Semiconductor Trade Statistics (WSTS) predicts growth of 11.8% in 2024. In the area of AI semiconductor revenue, Gartner anticipates double-digit growth of more than 25%, to $67.1 billion.

Among the many factors that will contribute to the growth will be the ability of semiconductor manufacturers to make the most of several key innovations.

Artificial Intelligence: as much as AI is placing demands on chip manufacturers for AI-ready hardware, the semiconductor companies themselves have embraced the potential of AI to improve process quality, optimize production, and increase efficiency in their fabs.

Simulated Fabrication: developing new recipes and processes is costly and time-consuming. Simulation, or virtual modeling, with AI and ML models enables manufacturers to simulate the process flow. They can generate a high volume of data in days instead of in the weeks or months it would take to produce enough wafers to gather this data. The models can quickly provide insights into bottlenecks, cycle time, and output, as well as predict problems that may impact products—all without having to interrupt current production.

Innovative Technologies: increasingly smaller chips necessitate greater accuracy in placement of both patterns and wiring. Manufacturers have turned to advances in fabrication technology such as robotic wafer handling and unique fabrication techniques such as additive manufacturing.

Innovative Materials: semiconductor companies have looked to materials such as gallium nitride (GaN) and silicon carbide (SiC), to achieve higher operating temperatures, high voltage resistance, a smaller form factor, and faster switching. Manufacturers’ continued ingenuity in working with innovative materials will help them overcome chip size limitations.

Conclusion

FAQs

Why is data preparation for AI considered a challenge in semiconductor manufacturing?

Data preparation for AI can be expensive in terms of time and resources, making it a barrier, especially for smaller companies. Historical data may also be insufficient due to evolving environments.

How does simulation help overcome data collection challenges for AI deployment?

Simulation allows for the creation of synthetic data, eliminating the need for extensive data cleaning. It provides an efficient way to generate diverse and high-quality data for AI training.

What are some practical benefits of using simulation in AI deployment?

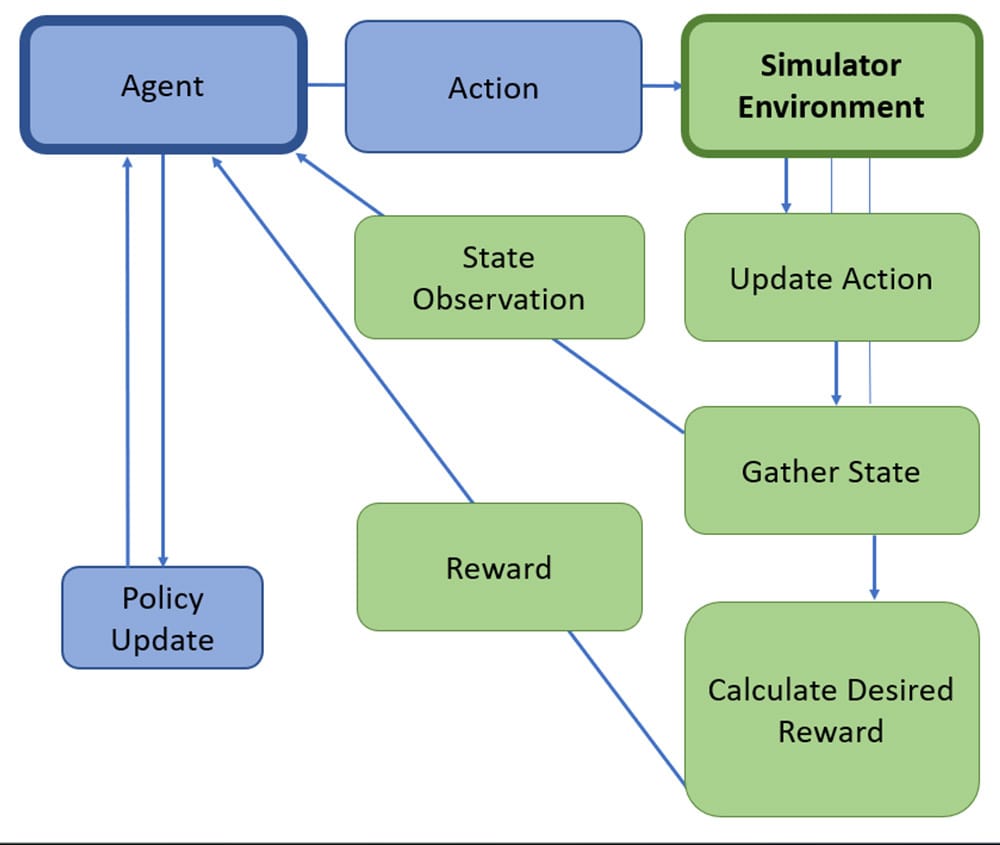

What role does simulation play in scenarios like Reinforcement Learning (RL) and Machine Learning (ML) in semiconductor manufacturing?

Simulation plays a crucial role in RL by providing a detailed environment for agents to learn and make decisions. In ML, it allows models to be trained on rich datasets, leading to operational efficiency gains and KPI comparisons.

Collecting and formatting diverse data required for deep learning is often expensive in both time and money, which is sometimes infeasible for smaller companies. Even if a manufacturer has the resources required to collect large amounts of data, historical data is often inadequate due to an evolving environment. For example, tools and process steps are constantly adapting to uncertainties found in supply chains, labor limitations, or change in part types. Evolving scenarios (i.e., adding more time constraint steps) in semiconductor manufacturing are especially common as technology nodes progress. Consequently, these rapid changes do not allow time for a diverse, historical dataset to develop to train models.

However, what if there was a way to get more quality data? What if AI could be explored on business essential use cases without the resource limitations of technology advancements? With simulation, you can answer these ‘what-ifs’! You can model various scenarios and generate synthetic data to use in AI training. Projects can be accelerated without the cost of cleaning raw datasets and in significantly less time than it takes to collect a sufficient amount of data. Quantifying the impact of changes in a simulated environment prior to production implementation is also key to avoiding unnecessary, costly risks. Furthermore, training models on rich datasets develop more robust, resilient models. Evaluating on-edge cases or other diverse scenarios that seldom occur in historical data increases generalization abilities of models, which improves accuracy overall.